The S&P 500 logged first loss in four sessions

Disappointing retail sales data and a profit miss from Target (TGT) dumped cold water on Wall Street today. The Dow snapped a five-day win streak -- its longest since May -- to settle 171 points lower. Meanwhile, the S&P 500 logged its first loss in four sessions, and the Nasdaq logged a triple-digit dip as well.

What's more, the Federal Reserve's July meeting minutes revealed the central bank is not yet content with inflation rates, and plans to move forward with aggressive interest rate hikes. However, the Fed also noted it may slow its economic tightening due to the state of the economy, and the risks its hawkish policy poses to gross domestic product (GDP) growth.

Continue reading for more on today's market, including:

- Guidance update draws options traders to TJX stock.

- Streaming name getting caught in the "meme stock" frenzy.

- Plus, more on TGT earnings; unpacking LOW's quarterly report; and Elon Musk's comments sweep up soccer stock.

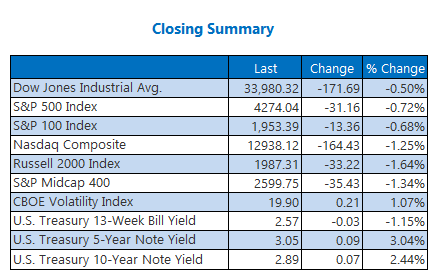

The Dow Jones Average (DJI - 33,980.32) lost 171.7 points, or 0.5% for the day. IBM (IBM) led the gainers, adding 0.9%. Meanwhile, Boeing (BA) paced the laggards, falling 2.8%.

The S&P 500 Index (SPX - 4,274.04) fell 31.2 points, or 0.7% for the day. Meanwhile, the Nasdaq Composite (IXIC - 12,938.12) shed 164.4 points, or 1.3% for the session.

Lastly, the Cboe Market Volatility Index (VIX - 19.90) rose 0.2 point, or 1.1% for the day.

5 Things to Know Today

- Kraft Heinz (KHC) recalled roughly 5,760 cases of Capri Sun juices due to possible contamination from a cleaning solution used on its processing equipment. (CNBC)

- Centers for Disease Control and Prevention (CDC) Director Rochelle Walensky called for an agency overhaul after "confusing and overwhelming" pandemic response. (MarketWatch)

- Discounted apparel and electronics failed to boost Target's profits.

- Options bulls brushed off Lowe's worse-than-expected revenue.

- Why Manchester United stock was swept up in a Musk tweet storm.

Oil Prices Snap Losing Streak on Lower Inventories

Oil prices settled higher on Tuesday to snap a three-day losing streak. Today's pop came after the Energy Information Administration (EIA) announced drops in crude and gasoline inventories, with the former falling by 7.1 million barrels last week. As a result, September-dated crude added $1.58, or 1.8%, to settle at $88.11 per barrel on the day.

Meanwhile, gold prices finished lower, making their worst close in two weeks. However, the yellow metal started to bounce back in electronic trading, in response to the Fed's meeting minutes. Nevertheless, December-dated gold shed $13, or 0.7%, to close at $1,776.70 an ounce.