Fed Chair Jerome Powell hinted at smaller rate hikes in his latest speech

Wall Street kept a close eye on Federal Reserve Chair Jerome Powell's speech at the Brookings Institution in Washington, D.C. today, and the central bank leader's comments seemed to be just what markets wanted to hear, after signaling smaller rate hikes in the future. Powell in his address said "it makes sense to moderate the pace of out rate increases as we approach the level of restraint that will be sufficient in bringing inflation down."

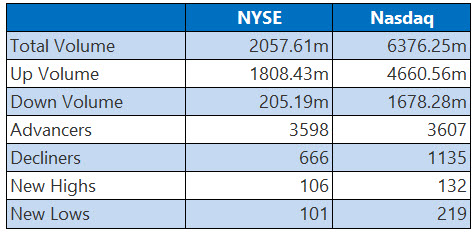

In response, stocks roared to life, with the Dow reversing its midday losses to log a 737-point win, while the S&P 500 and Nasdaq both surged as well. Additionally, all three indexes logged their second-straight monthly wins. Meanwhile, bond yields dropped in response to the news, with the 10-year Treasury yield falling below 3.712%.

Continue reading for more on today's market, including:

The Dow Jones Industrial Average (DJI - 34.589.8) added 737.3 points, or 2.2% for the day. Microsoft (MSFT) paced the gainers with a 6.2% win. Walmart (WMT) led the laggards with a 0.4% loss. It added 5.7% in November.

The S&P 500 Index (SPX - 4,080.11) gained 122.5 points, or 3.1% for the day, while the Nasdaq Composite Index (IXIC - 11,468.00) rose 484.22 points, or 4.4%. The former added 5.3% for the month, and the latter enjoyed a 4.3% monthly pop.

Lastly, the Cboe Volatility Index (VIX - 20.58) shed 1.3 point, or 6% for the session. It lost 20.4% for the month.

5 Things to Know Today

- Studies are showing that "long Covid" could be the next public health disaster in America, and could have a $3.7 trillion economic impact . (CNBC)

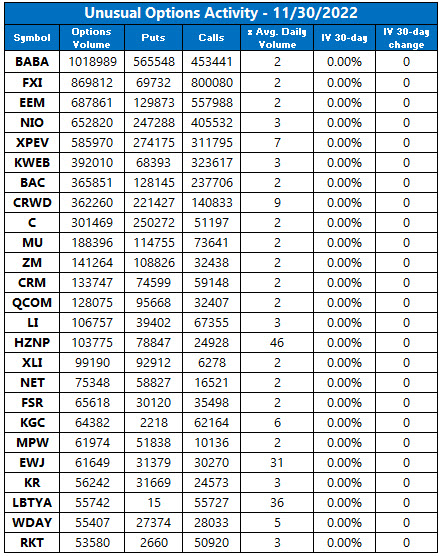

- U.S.-listed shares of Alibaba (BABA) are headed toward their best month in seven years, as investors brush off protests in China to focus on potential easing of strict Covid-19 policies in the region, as well as a push to vaccinate the elderly. (MarketWatch)

- Workday shared upbeat quarterly results.

- Horizon Therapeutics stock surged amid buyout buzz.

- Watch these technical levels before investing in shares of Constellation Brands.

Gold Nabs First Monthly Pop Since March

Oil prices rose for the day, thanks to a sharp drop in U.S. crude inventories. However, the tension surrounding China's Covid-zero policy, among other indicators, sent the commodity to a monthly loss. The front-month, January-dated crude added $2.35 cents, or 3%, to trade at $80.55 per barrel, though it shed 6.9% for the month.

Gold dropped for the day, as prices settled around the same time as Powell's speech. However, the precious metal logged its first monthly pop since March amid relative weakness of the U.S. dollar and slipping Treasury yields. The now most-active, February-dated gold fell $3.80 or roughly 0.2%, to settle at $1,759.90 an ounce, for the month, it gained 7.3%.