The Dow is eyeing a daily and weekly loss

This morning's hotter-than-expected nonfarm payrolls data is worrying traders this afternoon, as it could be a sign for the Fed to keep hiking interest rates, even after its Chair Jerome Powell suggested that the central bank could start to slow rate hikes into the end of the year. Additionally, investors fear that while demand for workers remains high, supply is still low, which could have an impact on wage inflation.

In response, the Dow Jones Industrial Average (DJI) was last seen down 209 points, while the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) also sit firmly in red. For the week, the Dow is headed for a muted loss, while the S&P 500 and Nasdaq eye weekly wins. Meanwhile, bond yields are back on the rise, with the 10-year Treasury yield back at 3.601%. Also just out of the European Union (EU), Russian oil has been officially capped at $60, following intense negotiations.

Continue reading for more on today's market, including:

- Bears target solar stock near 11-year highs.

- This energy name could surpass its April peak soon.

- Plus, options bulls rush Chinese EV giant; SPB surges on antitrust update; and CBRL shares dismal earnings report.

Bulls are targeting U.S.-listed shares of Chinese company Xpeng Inc - ADR (NYSE:XPEV), which was last seen up 28.2% at $12.78. The electric vehicle (EV) company announced 5,811 vehicles delivered in November and forecast a significant increase in December deliveries as its G9 production ramp-up accelerates while operating conditions return to normal. The stock recently brushed off an earnings miss, and today is trading at its highest level since September.

So far, 220,000 calls and 158,000 puts have been exchanged, which is six times the intraday average. The most popular position is the weekly 12/2 12-strike call, followed by the 11.50-strike call in the same series, with positions being sold to open at the latter.

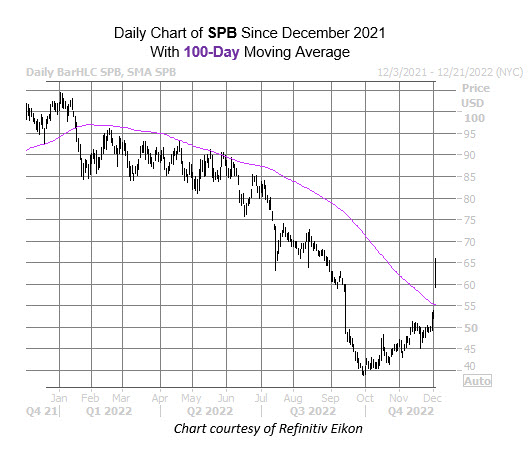

Spectrum Brands Holdings Inc (NYSE:SPB) has surged toward the top of the New York Stock Exchange (NYSE) today, last seen up 16.6% at $61.35, following news that Assa Abloy will sell its Yale and Emtek lock brands, among other assets, to Fortune Brands Home & Security (FBHS) in a deal with $800 million. The sale is a bid to overturn the U.S. Justice Departments opposition to Assa Abloy's purchase of Spectrum's hardware and home improvement unit amid concerns that the deal could lead to higher prices. SPB is set to close above long-time pressure at its 100-day moving average for the first time since May, thanks to today's pop.

Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL) is one of the worst performers on the Nasdaq today. The equity was last seen down 12.4% at $99.54 after its fiscal first-quarter earnings report. The old-time restaurant shared a huge profit miss and cut its full-year revenue forecast. The stock is trading at its lowest level since mid-October, and breached recent support at the 30-day moving average as a result.