The blue-chip index shed 252 points today

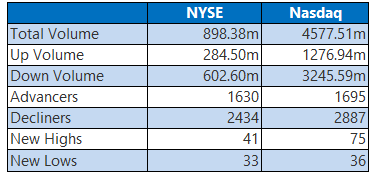

Stocks extended their slide on Thursday, as the lowest unemployment level since June sparked fears on Wall Street that the Federal Reserve will stay the course on aggressive interest rate hikes, despite signs of a cooling economy. The Dow shed 252 points, marking its third-straight session in the red alongside the S&P 500. The Nasdaq also settled firmly lower, as traders eyed the current earnings season that is quickly heating up, with Netflix (NFLX) set to report quarterly results after the bell.

Continue reading for more on today's market, including:

- Energy stock popular with options traders.

- Why Nordstrom stock could pull back further.

- Plus, Procter & Gamble reports earnings; what dented Alcoa stock; and 2 stocks drawing bear notes.

5 Things to Know Today

- Federal Reserve Governor Lael Brainard squashed hopes of lower interest rate hikes, with prices still at near four-decade highs despite easing inflation. (CNBC)

- Uber Technologies (UBER) is working with auto makers to create electric vehicles (EVs) for its ride-hailing and delivery businesses at a lower cost. (MarketWatch)

- Unpacking Procter & Gamble's mixed quarterly results.

- How a bleak forecast overshadowed Alcoa's revenue win.

- Bear notes sent these 2 stocks substantially lower today.

Investors Seek Potential Recession Refuge in Gold

Oil prices edged higher on Thursday to settle back above the psychologically significant $80 level. Investors brushed off a fourth consecutive weekly gain in U.S. crude supplies due to strong demand expectations out of China. February-dated crude added 85 cents, or 1.1%, to settle at $80.33 per barrel.

Gold prices also rose to once to once again settle at their highest level since April. Fears of recession drove investors to the safe-haven metal today. February-dated gold added $16.90, or 0.9%, to settle at $1,923.90 per ounce.