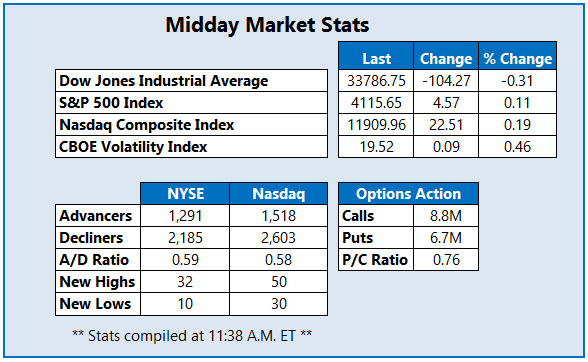

The Dow is 104 points lower at midday

The Dow Jones Industrial Average (DJI) is down triple digits midday, as investors await comments from Federal Reserve Chair Jerome Powell before the Economic Club of Washington. Earnings season is still going strong, with plenty of quarterly results to sift through today. Meanwhile, oil prices are on the rise amid China's reopening measures and raised export prices to Asia from Saudi Arabia.

Continue reading for more on today's market, including:

- Why Baidu stock is surging today.

- Disappointing forecast hurts Chegg stock.

- Plus, options traders target PINS; OSH soars on potential buyout; and AOSL plummets after earnings.

Options traders are blasting Pinterest Inc (NYSE:PINS) after the company's fourth-quarter revenue miss and disappointing forecast. So far, 101,000 calls and 59,000 puts have been traded, which is five times the intraday average volume. The weekly 2/10 30-strike call is the most popular, with new positions opening there. PINS is down 3.2% at $26.99 at last glance, but no fewer than eight analysts raised their price targets, while J.P. Morgan Securities slashed its price objective by $1 to $27. During the last nine months, PINS has added 32.5%.

Oak Street Health Inc (NYSE:OSH) is soaring, up 30.9% to trade at $33.98 at last glance, after earlier scoring a one-year high of $34.63. This bull gap follows news that CVS Health (CVS) will potentially buy the company for $10.5 billion. The stock already conquered pressure at its 260-day moving average in January, and has added 56.7% since the start of 2023.

Meanwhile, Alpha and Omega Semiconductor Ltd (NASDAQ:AOSL) is down 13.5% at $31.21 at last check, after the company's disappointing fiscal second-quarter results and fiscal third-quarter-quarter revenue forecast. Year-to-date, however, AOSL is still holding on to an 8.8% lead.