Stocks are starting the week higher as bank stocks rebound

Stocks are on the mend this afternoon, after the forced takeover of Credit Suisse (CS) sparked a rebound in regional banks. The Dow Jones Industrial Average (DJI) is more than 300 points higher, while the Nasdaq Composite Index (IXIC) and S&P 500 Index (SPX) sport more modest leads.

Continue reading for more on today's market, including:

- Regional bank stock making big moves today.

- Foot Locker stock sees post-earnings options surge.

- Plus, call traders bet on Ally Financial; OSIS soaring on new order; and BBBY tumbles even more.

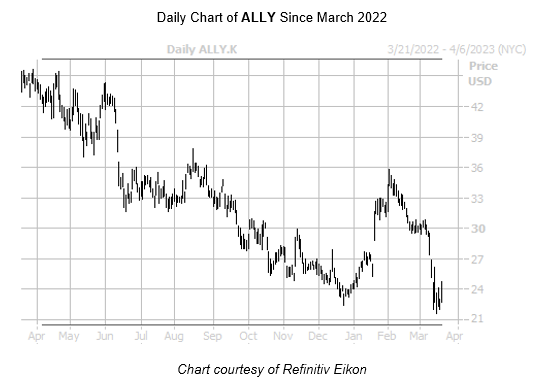

Options bulls are flocking towards Ally Financial Inc (NYSE:ALLY), as traders still try to decide how to navigate the landscape following SVB Financial Group's (SIVB) collapse. The shares of ALLY were last seen up 8.3% to trade at $24.13, and more than 13,000 calls have been exchanged so far -- six times the amount typically seen at this point. The most popular contract is the weekly 3/24 23-strike call, where new positions are being opened. Ally Financial stock is down 46.% over the last 12 months, as it remains near roughly three-year lows.

Near the top of the Nasdaq today is OSI Systems, Inc. (NASDAQ:OSIS), which was last seen 12.9% higher to trade at $102.89, after the company received a $600 million order from Mexico for cargo and vehicle inspection systems. Year-to-date, OSIS is now up more than 28%.

Bed Bath & Beyond Inc (NASDAQ:BBBY) is trading near the bottom of the Nasdaq, after the embattled retailer called for shareholders to approve a reverse stock split. The company stressed that the split would "not have any effect" on its the equity's value or shareholder's proportional ownership. The shares were last seen 16.2% lower to trade at 86 cents, adding to a 96% year-over-year deficit.