Regional bank stocks are rallying

Wall Street is mixed midday, paring this morning's gains despite rallying regional banks stocks. The Dow Jones Industrial Average (DJI) still sports a triple-digit lead, while the S&P 500 Index (SPX) is fractionally higher. The Nasdaq Composite Index (IXIC), meanwhile, has moved lower. In other news, oil prices are continuing to climb after adding 3.5% last week, with West Texas Intermediate (WTI) crude up 2.9% at last glance.

Continue reading for more on today's market, including:

- Caterpillar stock facing multiple headwinds.

- Analyst notes Roku stock's long-term strength.

- Plus, call traders blast blue-chip name; tech stock adds to 2023 gains; and DiamondHead stock pulls back from record highs.

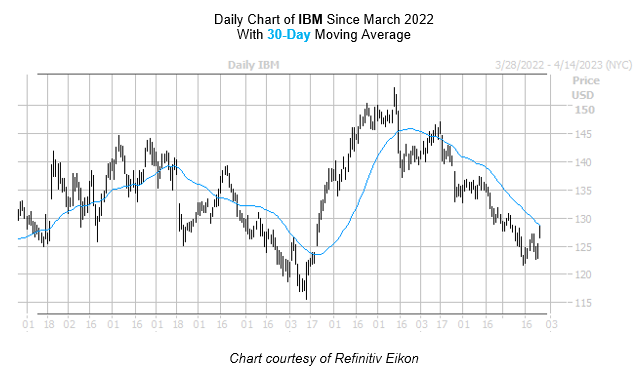

IBM Common Stock (NYSE:IBM) is getting blitzed by call traders today, with over 27,000 bullish bets crossing the tape so far today -- nine times the average intraday volume. The most volume is taking place at the weekly 3/31 130-strike call, where new positions are being opened. Shares of the blue-chip tech behemoth are up 2.6% at $128.49 at last check, though the catalyst for today's optimism is unclear. IBM still sports small year-to-date and year-over-year deficits.

Software concern Gorilla Technology Group Inc (NASDAQ:GRRR) is up 19.6% to trade at $10 at last glance, after news broke that the firm partnered with Hailo and Lanner Electronics to build the Next-generation Edge artificial intelligence (AI) appliance for robust video analytics. Today's bull gap on the charts puts GRRR at its highest level since December, and its year-to-date lead at 27.7%.

Meanwhile, DiamondHead Holdings Corp (NASDAQ:DHHC) was last seen down 8.2% to trade at $13.48, following its 22.4% plunge on Friday. The shares hit an all-time high of $28.50 after the company last week announced a PIPE investment in which investors agreed to purchase $80 million in convertible promissory notes. Now pulling back, the shares remain up 34% in 2023.