March inflation data will be released tomorrow

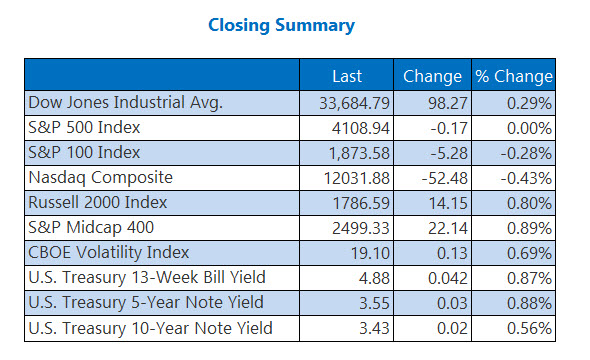

The major indexes extended their shaky trading, with the blue-chip index logging its fourth-straight daily gain. Recession fears ahead of tomorrow's March inflation reading pushed the Nasdaq and S&P 500 lower, after both struggled for direction most of the day. CarMax (KMX) made noise after earnings as well, while oil snuck back above its round $80 mark.

Continue reading for more on today's market, including:

- Dating stock edged higher on analyst praise.

- Blue-chip bank prepares for earnings.

- Plus, surging biotech concern; telecom stock to watch; and bulls blast WW International stock.

Things to Know Today

- Ford Motor (F) is investing in its Ontario, Canada plant, putting $1.3 billion toward transitioning it to foster electric vehicle (EV) production. The company hopes to release its own line of EV within the next decade. (CNBC)

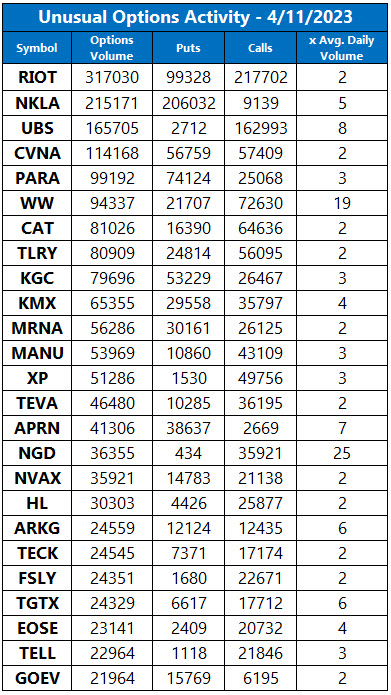

- During its annual Vaccine Day, pharmaceutical leader Moderna (MRNA) revealed it is working on a vaccine for Lyme disease, which is contracted through infected tics and causes a myriad of severe symptoms. (MarketWatch)

- Options traders flocked toward biotech powerhouse.

- Telecomm stock dialed in right now.

- Bull note blasted WW International stock.

Oil Clears Multi-Month Peak

Oil closed at a multi-month high following yesterday's lackluster performance and traders eye tomorrow's data release. For the session, May-dated crude added $1.79, or 2.2%, to close at $81.53 per barrel -- its highest mark since Jan. 23.

For a sixth-straight day gold finished above the $2,000 mark, following a supportive U.S. dollar. June-dated gold still tacked on $15.20 or 0.8%, to settle at $2,019 an ounce today.