Stocks struggled as recession fears loomed

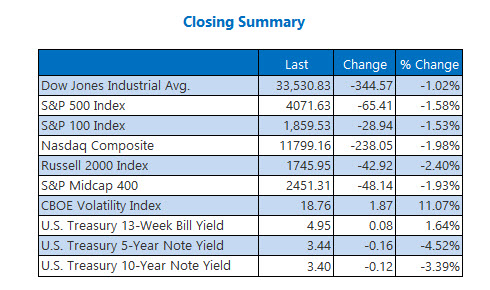

Stocks turned in steep losses for Tuesday's trading, as investor fears regarding the potential of a revived bank sector slide were prodded. First Republic Bank (FRC) reignited worries, after posting a 40% deposit drop in the first quarter. A slew of economic data reports and impending Big Tech earnings are also curating today's market buzz.

Continue reading for more on today's market, including:

- Pre-earnings bull signal flashing on Microsoft stock.

- Aluminum giant falls below key trendline.

- Plus, record-breaking bank stock slide; post-earnings jump for MMM; and long-term trendlines to watch.

Things to Know Today

- Retailer Gap (GPS) is joining the slew of companies setting out to find cost savings, starting with employee layoffs. The company expects to slash 500 positions to improve efficiency and overhead. (CNBC)

- Biogen's (BIIB) ALS drug torferson landed accelerated approval at the Food and Drug Administration (FDA). (MarketWatch)

- Behind First Republic Bank stock's record slide.

- Earnings boost blue chip MMM.

- Long-term trendlines facing the ultimate test.

Gold Closes Higher as Fed Fears Loom

Recession fears and energy demand sent oil lower in today's session. May-dated crude dropped $1.69, or 2.1%, to close at $77.07 per barrel.

Commodity traders remained unsure toward the broader interest rate outlook from the Fed, sending gold higher for the day. June-dated gold added $4.70 or 0.2%, to settle at $2,004.50 an ounce.