The PPI reading took precedence over retail sales data

The Dow settled at its highest level since August on Wednesday, securing a triple-digit gain for its fourth-straight win. The producer price index (PPI) -- which staged its steepest drop since April 2020 in October -- was responsible for much of today's optimism, and helped investors overlook disappointing retail sales data. The Nasdaq inched higher to close at its highest level in more than three months as well, while the S&P 500 saw a minor win of its own despite rising Treasury yields.

5 Things to Know Today

- President Joe Biden and Chinese President Xi Jinping met for the first time in a year to discuss artificial intelligence (AI) and restrictions to high-end tech. (CNBC)

- Warren Buffett’s Berkshire Hathaway exited positions on General Motors (GM) and Activision Blizzard (ATVI) in the third quarter, per a regulatory filing. (MarketWatch)

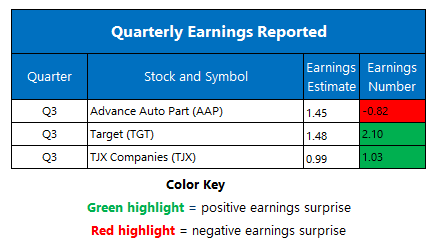

- What set Target stock on track for its best day since 2019.

- Molson Coors Beverage stock's setup draws analyst praise.

- Digging into a rare losing streak for Wall Streat's "fear gauge."

Oil Snaps Win Streak as Inventories Rise

Oil prices snapped a four-day win streak on Wednesday, after a more than 17 million-barrel rise in U.S. commercial crude inventories, according to the Energy Information Administration's (EIA) latest report. December-dated West Texas Intermediate (WTI) crude shed $1.60, or 2%, to close at $76.66 a barrel for the day.

Gold prices closed near breakeven, with hopes that the Federal Reserve is done hiking interest rates and a weaker U.S. dollar still providing support. December-dated gold fell $1.40, or 0.07%, to close at $1,965.10 an ounce for the day.