Alphabet and Tesla earnings' reactions don't bode well for the rest of Big Tech

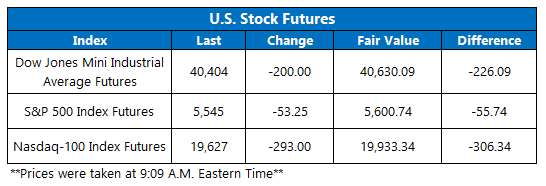

Dow Jones Industrial Average (DJIA), S&P 500 Index (SPX), and Nasdaq-100 Index (NDX) futures are pointed sharply lower this morning, taking a hit in the wake of lackluster quarterly reports from Alphabet (GOOGL) and Tesla (TSLA). While this earnings season has been upbeat so far, with 80% of SPX companies that reported surpassing expectations, the disappointing opening salvo of Big Tech reports has poured cold water on the broader tech sector outlook.

Continue reading for more on today's market, including:

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.2 million call contracts and 803,365 put contracts exchanged on Tuesday. The single-session equity put/call rose to 0.63, while the 21-day moving average remained at 0.66.

-

Tesla Inc (NASDAQ:TSLA) stock is down 8.5% before the open, after the

electric vehicle (EV) giant reported a second-quarter earnings miss, with revenue seeing a 7% year-over-year drop in June despite beating expectations. In the last 12 months, TSLA shed more than 8%.

-

Despite better-than-expected earnings and revenue for the second quarter,

Alphabet Inc (NASDAQ:GOOGL) stock is 4.1% lower ahead of the bell. Dinging shares is lackluster

YouTube advertising revenue. GOOGL boasts a 30.1% lead so far in 2024.

-

AT&T Inc (NYSE:T) stock is brushing off a second-quarter revenue miss, after it added a higher-than-anticipated 419,000

wireless phone subscribers. T is up 3.4% in premarket trading, and already sports a healthy 21.8% year-over lead.

- Blue-chip earnings and more economic data on tap this week.

European Markets Lower Amid Bank Earnings

Asian markets were lower across the board Wednesday. Japan’s Nikkei posted a 1.1% loss, despite the country’s composite purchasing managers’ index (PMI) for July coming in a 52.6, pointing to solid growth. Hong Kong’s Hang Seng followed behind with a 0.9% loss, while China’s Shanghai Composite and the South Korean Kospi shed 0.5% and 0.6%, respectively. Generally, electric vehicle (EV) stocks in the region turned lower after Tesla earnings disappointed.

European markets are down today as well, as investors unpack bank earnings. The euro zone’s flash PMI reading showed business activity stalling in July, while it picked up in the U.K. due to manufacturing growth. Meanwhile in Germany, consumer confidence rose. At last glance, London’s FTSE 100 is marginally lower, while France’s CAC 40 and Germany’s DAX lose 1% and 0.8%, respectively.