Tech stocks have sent the Nasdaq back below 20,000 today

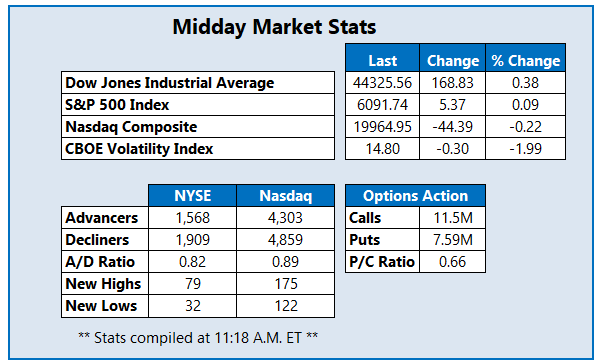

Stocks are a mixed bag this afternoon. The Dow Jones Industrial Average (DJI) boasts a 168-point gain and is heading for a fourth straight win. The S&P 500 Index (SPX) and Nasdaq Composite Index (IXIC), on the other hand, are struggling for direction. The former is testing a four-day win streak despite hitting another intraday record high, while the latter has breached the psychologically-significant 20,000 level.

Jobs data was in focus this morning, but now attention turns to the World Economic Forum in Davos, Switzerland, where President Donald Trump just announced he'll "demand that interest rates drop immediately."

Continue reading for more on today's market, including:

Netflix Inc (NASDAQ:NFLX) stockis still seeing positive tailwinds from its "near flawless" fourth-quarter earnings report. Shares are 3.1% higher at $938.42 at last glance, just shy of yesterday's all-time high of $999. Options traders aren't losing interest either, with 86,000 calls and 47,000 puts already traded so far today -- three times the average intraday volume. New positions are being bought to open at most of the 20 most active contracts, led by the January 1,000 call. Year over year, NFLX s up 79.1%.

U.S.-listed shares of China-based TAL Education Group (NYSE:TAL) stock is near the top of the New York Stock Exchange (NYSE), up 15.2% at $10.53 at last glance. The security is getting a boost form positive fiscal third-quarter financial results, with sales jumping 62% on accelerated growth in its artificial intelligence (AI) learnings devices unit. Today's positive price action puts TAL back in the black for the year.

Shares of Acushnet Holdings Corp (NYSE:GOLF), parent company of Titleist and FootJoy,are some of the worst on the NYSE this afternoon, following a bear note at JPMorgan Securities. The analyst reduced its rating on GOLF to "underweight" and cut its price target to $64, citing a revision to the company's revenue forecast. In response, Acushnet stock was last seen 10.4% lower at $66.83, dragging it to a 6.6% year-to-date deficit.