Investors are unpacking earnings from several megacap tech companies

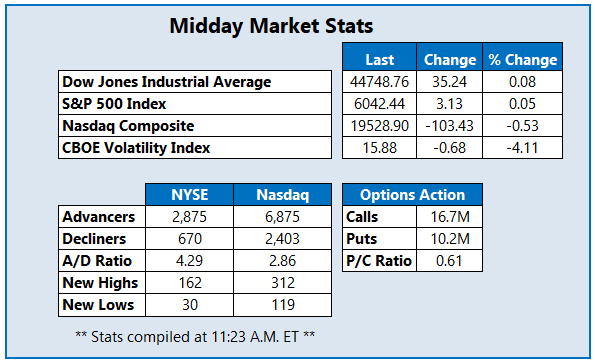

Stocks are struggling for direction amid a mixed batch of earnings results. Several megacap tech companies reported quarterly results, while investors assess a fourth-quarter gross domestic product (GDP) reading that missed expectations. At last check, the Dow Jones Industrial Average (DJI) was modestly higher, the S&P 500 Index (SPX) was flat, and the Nasdaq Composite (IXIC) was on track for a second consecutive loss.

Continue reading for more on today's market, including:

Las Vegas Sands Corp. (NYSE:LVS) is seeing unprecedented call volume after earnings. Already, more than 112,000 bullish bets have crossed the tape, which is 28 times the average intraday volume. New positions are opening at the most popular contract, the June 45 call. The casino and resort stock is 10.2% higher at $47.87 at last glance, but remains 6% lower on a year-to-date basis. Today's pop comes after Las Vegas Sands announced mixed fourth-quarter results, with earnings falling short of estimates while revenue was roughly in line.

Oshkosh Corp (NYSE:OSK) is one of the top stocks on the New York Stock Exchange (NYSE) today, last seen 17.1% higher at $111.97 -- bouncing to its highest level since early December. Today's gains come after the industrial giant reported a strong fourth quarter and full-year earnings guidance. Year to date, OSK is now up 16.5%.

Meanwhile, Whirlpool Corp (NYSE:WHR) stock is near the bottom of the NYSE this afternoon, down 18.1% at $106.10 at last glance. The home appliance manufacturer and marketer reported a fourth-quarter loss and offered soft guidance for 2025, pushing shares 5.7% lower year to date.