AMD and GOOGL's post-earnings drops are weighing on the tech-heavy Nasdaq

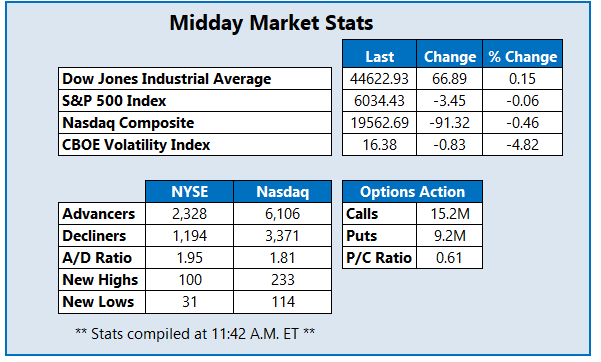

Stocks are struggling for direction today, as investors unpack this morning's private payrolls data and the ISM services index, which came in at 52.8% in January -- below expectations of 54.3% but still above 50, indicating expansion. The Nasdaq Composite (IXIC) is firmly lower following post-earnings drops from Alphabet (GOOGL) and Advanced Micro Devices (AMD), while the S&P 500 Index (SPX) sits flat and the Dow Jones Industrial Average (DJI) climbs to a comfortable gain.

Continue reading for more on today's market, including:

- Alphabet stock eyes worst day since 2023.

- Options traders are targeting Walt Disney stock after earnings.

- Plus, three stocks moving after quarterly results.

Options traders are targeting fast-casual restaurant chain Chipotle Mexican Grill Inc (NYSE:CMG) after the company's earnings report. Fourth-quarter earnings came in slightly above estimates, while revenue met expectations and the same-store forecast disappointed. So far, 60,000 calls and 72,000 puts have been exchanged, which is 4 times the average daily options volume already. The weekly 2/7 54-strike put is the most popular, where new positions are being bought to open. At last check, CMG was down 2.3% at $57.64, with support at the $56 level keeping losses in check. Year over year, the equity is up 14%.

Communications stock Aviat Networks Inc (NASDAQ:AVNW) is up 26.5% at $26.00, after the company posted better-than-expected fiscal second-quarter earnings and revenue. Northland Securities reiterated its "outperform" rating and hiked its price target to $30 from $27 after the event. Gapping to its highest levels since September, AVNW is now up 46.4% since the start of the year.

Allegiant Travel Co (NASDAQ:ALGT) is down 17% at $82.18 at last check, despite better-than-expected fourth-quarter results, after disappointing guidance. The airplane stock is brushing off a handful of price-target hikes too. Gapping further away from last week's 52-week highs, ALGT is hanging on to a slim 8% year-over-year gain.