Mexico will announce retaliatory tariffs on Sunday

Stocks are freefalling as President Donald Trump's tariffs against Mexico, Canada, and China take effect. Trade war concerns continue to escalate, with Mexico promising to announce retaliatory tariffs on Sunday. Canada is looking to place a 25% tariff, while China revealed an up to 15% levy on certain U.S. products earlier today.

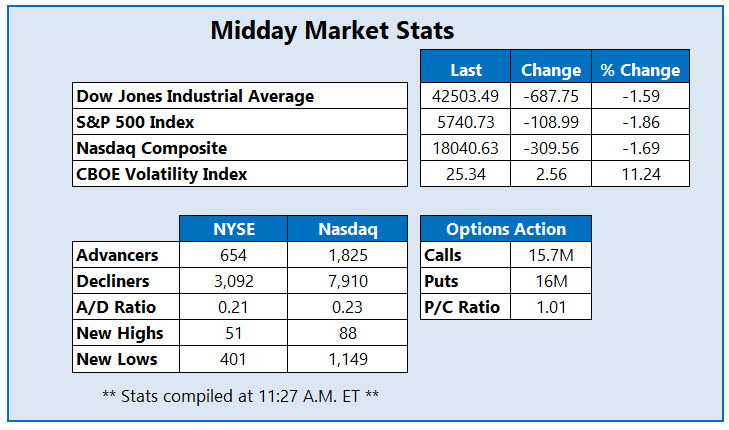

In response, the Dow Jones Industrial Average (DJI) is down 687 points. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are sporting triple-digit losses of their own, the latter flirting with correction territory as several major companies warn of higher costs.

Continue reading for more on today's market, including:

Truist Financial Corp (NYSE:TFC) stock is getting pummeled in the options pits today, with 27,000 calls exchanged so far today -- 13 times the volume typically seen at this point -- as opposed to 4,345 puts. The most popular contract is the June 50 call, where new positions are being bought to open. TFC was last seen down 4.4% at $43.42 amid broader market weakness, and eyeing its biggest single-day percentage loss since December. The financial services stock still sports a 19.7% year-over-year lead, however.

Biogen Inc (NASDAQ:BIIB) stock is among the SPX's outperformers today, up 3.5% to trade at $146.68 at last glance, though a catalyst for today's surge remains unclear. The equity is eyeing a third-straight daily gain. Shares continue to struggle with overhead pressure at the $150 level, though, which has been capping price action since January. In the last 12 months, BIIB shed more than 33%.

Despite the tech retailer reporting better-than-expected fourth-quarter results and raising its outlook, Best Buy Co Inc (NYSE:BBY) stock is at the bottom of the SPX today. The equity was last seen down 13.4% at $75.12 amid trade war concerns, and could today see its third daily loss in four, as well as its biggest loss since March 2020. Shares are also breaking below recent support at the 40-day moving average, as they extend a 25.1% nine-month deficit.