The ISM services index beat expectations

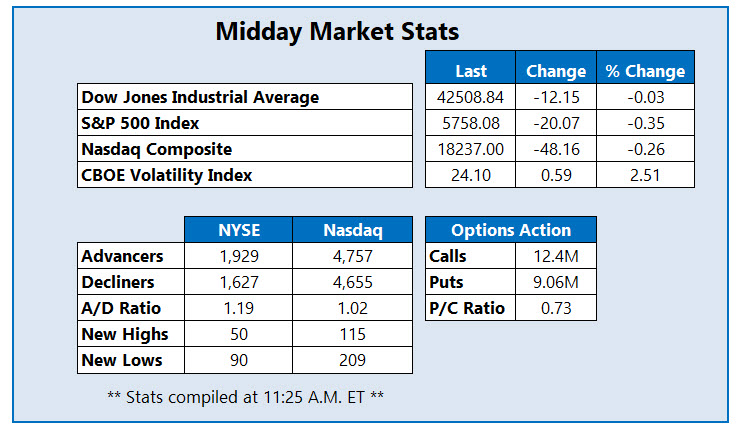

The Dow Jones Industrial Average (DJI) is trading near breakeven this afternoon, while the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are lower. Traders are digesting weak jobs data and tariffs, with Commerce Secretary Howard Lutnick's suggested trade deal with Canada and Mexico yet to come to fruition. A better-than-expected Institute for Supply Management (ISM) services index could be keeping today's losses in check, as President Donald Trump looks at which sectors could get relief from tariffs.

Continue reading for more on today's market, including:

Abercrombie & Fitch Co (NYSE:ANF) stock is seeing unusual options activity today, with 16,000 calls and 31,000 puts traded so far today -- 8 times the volume typically seen at this point. The most active contract is the May 70 put, where positions are being opened. ANF was last seen off 15% at $81.70, brushing off the company's better-than-expected results for the fourth quarter after a dismal current-quarter and fiscal year outlook. The equity is on track for a third-straight daily loss and worst day since Jan. 13, and earlier hit a 52-week low of $79.77. So far in 2025, Abercrombie stock already shed 45.8%.

Freeport-McMoRan Inc(NYSE:FCX) stock is near the top of the SPX today, last seen up 7% at $37.33. Rising metal prices, a weaker U.S. dollar, and increasing demand for gold as traders turn to the safe-haven commodity during the trade war, are boosting the equity. FCX could snap its four-day losing streak with its best single-day percentage gain since September, but has yet to conquer the 40-day moving average on a bounce off yesterday's a 52-week low of $34.26.

Meanwhile, Marathon Petroleum Corp (NYSE:MPC) is one of the worst stocks on the SPX today, down 6.1% to trade at $133.87 at last glance. Tariffs and the Organization of the Petroleum Exporting Countries and its allies' (OPEC+) move to lift outputs dinged the shares. The oil stock is eyeing its worst single-day percentage drop since October, as well as its third-straight daily drop, while carrying a 23.2% year-over-year deficit.