President Donald Trump is retaliating against Ontario's electricity duties

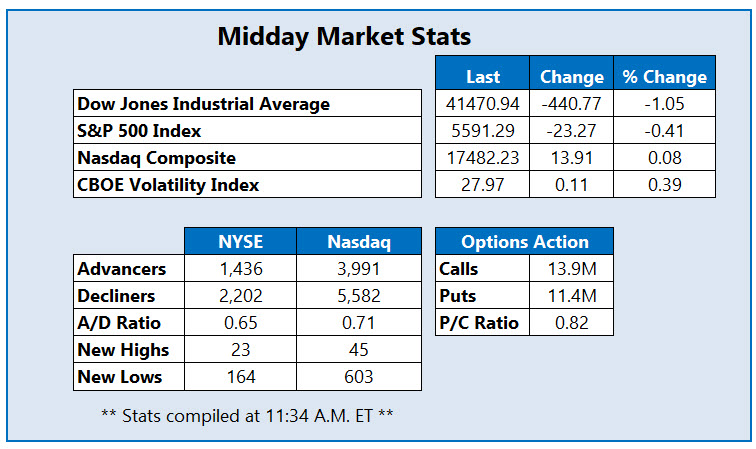

The Dow Jones Industrial Average (DJI) was last seen down triple digits, after President Donald Trump said he would hike Canadian steel and aluminum tariffs to 50% from 25%, effective tomorrow. The S&P 500 Index (SPX) is also lower as traders weigh economic concerns following Trump's latest comments, while the Nasdaq Composite (IXIC) is modestly higher after yesterday marking its worst loss since 2022.

Continue reading for more on today's market, including:

- Why Lennar stock could see more bear notes.

- 2 retail stocks in hot water after profit warnings.

- Plus, tech stock eyes worst day ever; investors buy CRWD's dip; and why EXPE is sinking.

Asana Inc (NYSE:ASAN) is seeing unusual options activity today, with 4,747 calls and 9,124 puts traded so far, which is 8 times the intraday average volume. The most active contract is the weekly 3/14 14-strike put. ASAN is down 27.7% to trade at $12.06 at last glance, brushing off a fourth-quarter earnings and revenue beat as it paces for its worst day on record. Today's negative price action follows weak guidance and news that CEO Dustin Moskovitz will retire. ASAN earlier hit its lowest level since December, and shed 40.8% so far in 2025.

CrowdStrike Holdings Inc(NASDAQ:CRWD) stock is one of the best SPX components today, last seen up 4.7% to trade at $323.43. Traders look to be buying the dip, after the stock yesterday hit its lowest level since November as it extended a pullback from its Feb. 19, record high of $455.59. Shares added 29.8% in the last six months, and are on track to snap a five-day losing streak following their break below the 220-day moving average.

Expedia Group Inc (NASDAQ:EXPE) is one of the worst stocks on the SPX today, last seen down 7.9% at $162.75 after Delta Air Lines (DAL) lowered its outlook, citing weak domestic travel demand. EXPE is eyeing its worst single-day percentage loss since May, and could today notch its third negative session in four. EXPE is also trading at its lowest level since November, despite notching a Feb. 10, four-year high of $207.74 and sporting an 18.2% year-over-year lead.