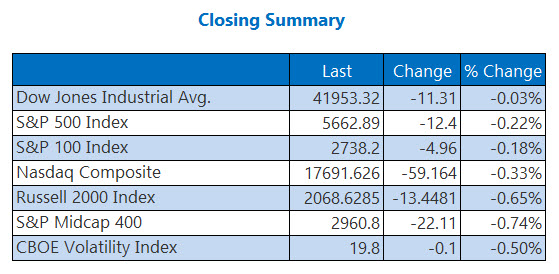

All three major indexes finished with modest losses

The key word on Wall Street today is "uncertainty," as traders consider yesterday's Fed decision and following commentary, as well as President Trump's trade policy. Stocks struggled for direction in the afternoon despite the Dow and Nasdaq boasting triple-digit leads midday, and after a rocky last few minutes of trading, all three major indexes finished modestly lower.

Continue reading for more on today's market, including:

- Temu parent brushing off disappointing fourth-quarter results.

- The basics of options pricing: time value and intrinsic value.

- Plus, 2 more earnings reports today; 10 tips for March Madness and options; and why RIVN was downgraded.

5 Things to Know Today

- Eli Lilly (LLY) is launching a weight-loss drug in India, beating Novo Nordisk (NVO) to the punch. (Reuters)

- Lyft (LYFT) said it plans to offer driverless rides as soon as this summer, with human drivers able to transition to other work such as fleet management. (Bloomberg)

- 2 stocks attracting options activity after earnings.

- 10 commandments for March Madness and options trading.

- Rivian Automotive stock slips on downgrade.

Oil Prices Continue Rise

Oil prices rose for the second day as tensions rise in the Middle East. April-dated West Texas Intermediate (WTI) crude rose $1.10, or 1.6%, to end at $68.26 a barrel.

Gold futures rose 0.1% to settle at $3,043.80 per ounce.