The Dow was last seen 970 points lower

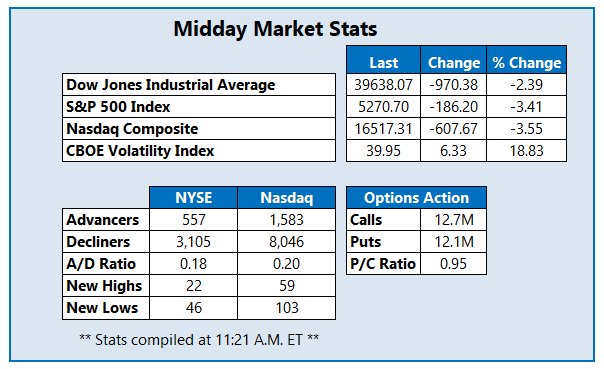

Stocks are retreating Thursday, giving back a portion of yesterday’s historic gains after a temporary easing of global trade tensions. The celebratory mood is proving to be short-lived, however, as traders refocus on the broader implications of President Trump’s trade policy -- especially after the White House clarified that tariffs on Chinese goods now total 145%. All three major benchmarks are sharply lower this afternoon, with the Dow Jones Industrial Average (DJI) down 970 points.

Continue reading for more on today's market, including:

- Microsoft stock lower after price-target cut.

- Breaking down Costco stock's post-earnings pop.

- Plus, bulls target DJT; PSMT pops after earnings; more acquisition drama for X.

Trump Media & Technology Group Corp (NASDAQ:DJT) is once again drawing attention. The stock surged more than 21% yesterday after President Trump posted on Truth Social, "THIS IS A GREAT TIME TO BUY!!!" just minutes after the open. The post ended with the letters “DJT” -- his initials, and the ticker symbol for the company he holds a majority stake in. The message came just before he lowered tariffs, giving traders who followed his advice a quick boost. DJT was last seen down 6% to trade at $19.05, and it remains 44.8% lower year to date. Drilling down to today's options activity, 38,000 calls and 14,000 puts have been traded so far -- triple the average intraday volume. Positions are being bought to open at the leading weekly 4/11 21-strike call.

PriceSmart Inc (NASDAQ:PSMT) is among the IXIC's top gainers, last seen up 6.2% to trade at $91.07. The warehouse club operator reported fiscal second-quarter earnings of $1.45 per share, easily topping expectations, while revenue of $1.36 billion was in line with estimates. Despite today's gains, PSMT remains just below its year-to-date breakeven mark.

Shares of United States Steel Corp (NYSE:X) are some of the SPX's worst performing, down 6.8% at $42.04. The bear gap follows comments from President Trump, who said he does not want the steelmaker to be acquired by a Japanese company, appearing to signal opposition to Nippon Steel’s bid for U.S. Steel. On the charts, X is puling back from yesterday's rally to its highest level since March 2024. While the 30-day moving average is providing support, the stock broke below its year-over-year breakeven.