Last week, investors absorbed more headlines on tariffs, plus Fed Chairman Jerome Powell’s testimony to Congress, inflation data, and the release of the January consumer price index (CPI) and producer price index (PPI) reports.

“One scenario worth considering is that the 10-year yield is sitting on potential support from its 80-day moving average and the November closing high ahead of inflation data this week. If the retreat from higher yields since mid-January is over, a potential headwind for equity bulls is higher 10-year yields stemming from higher-than-expected inflation data on Wednesday and Thursday.”

-Monday Morning Outlook, February 10, 2025

Per the excerpt above, in response to hotter-than-expected CPI data, yields on the 10-year Treasury note popped from levels I anticipated could be supportive ahead of the release of the inflation data. The knee-jerk reaction resulted in a pullback from equities too. But, per the chart below, the yield on the treasury note peaked on Wednesday, even with hotter-than-expected PPI data on Thursday morning.

By Friday’s close, the 10-year Treasury yield had done a round trip, closing the week at around the same level as the previous Friday’s close.

“…given that there still has not been a close above the Jan. 24 close (that preceded the Jan. 27 gap lower) at 6,101, the risk to bulls is the bearish ‘island reversal’ still in play…Bulls, on the other hand, are hopeful that the bearish pattern simply signaled choppy short-term price action, the SPX is just above multiple potential support levels, but also just below previous highs attained last month between 6,119 (the all-time closing high) and 6,128 (the all-time intraday high)… The first key level...is 6,013, which marked highs in November and again in early January… pre-Inauguration Day close of 5,995 in mid-January. As the market reacts to both negative and positive headlines on tariffs, it is of note that the SPX has closed either above or on this level each trading day since the inauguration of President Donald Trump.”

-Monday Morning Outlook, February 10, 2025

In retrospect, one would have to grade last week’s price action as a positive for bulls, as the S&P 500 Index (SPX--6,114.63) ultimately closed higher. Moreover, with Thursday's close at 6,115, the benchmark finally closed above the pre-gap close that created a potential bearish “island reversal” pattern.

But, per the chart below, it had to first test key levels of support that I talked about in last week’s commentary before nullifying the bearish pattern.

For example, the immediate response to Wednesday’s CPI data was a selloff. But note that the intraday low was at 6,003, site of its 50-day moving average, above the round 6,000 millennium level and just six points above the SPX’s close ahead of President Trump’s Inauguration Day at 5,997.

While the SPX has not been positive every day, like Meta Platforms (META) since President Trump took office, the index has not experienced a close below the pre-inauguration close of 5,997, despite two intraday moves below it.

In fact, on Wednesday, the SPX closed above 6,013, which I also pointed out as a key level since it marked notable short-term highs in November and January.

There is work to be done, however, as Friday’s high was the site of another important area that I discussed last week between 6,119 and 6,128, the site of January’s all-time intraday and closing highs. We enter this week’s trading just below this area, but with multiple levels of potential support just below, including December’s closing high at 6,090.

“After five straight weeks of net selling, hedge funds snapped up US equities at the fastest pace since November, resulting in the heaviest net buying of single stocks in more than 3 years, according to Goldman Sachs Group Inc.’s prime brokerage report for the week ended on Feb. 7… It was their second largest buying spree in the last five years as they covered covering short bets and added long positions.”

-Bloomberg, February 10, 2025

With the SPX and tech-oriented Invesco QQQ Trust (QQQ--538.15) entering the week at prior highs, the question is who or what pushed the index to new all-time highs. With many companies reporting earnings the past couple of weeks, corporate buyback activity could be more in play relative to a few weeks ago.

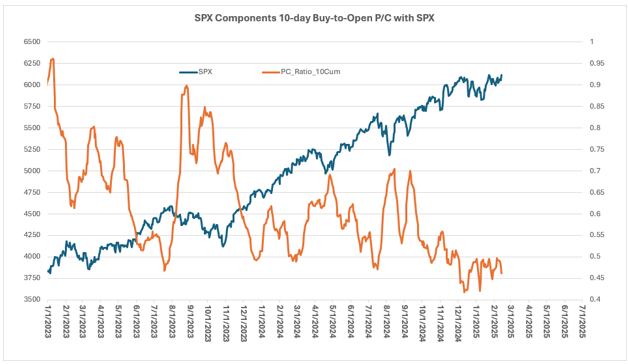

Equity option buyers on SPX component stocks have been and remain supportive, as put buying relative to call buying has lingered around multi-year lows since the beginning of December. This segment of the market is usually positioned wrong at extremes in sentiment and were most bullish just ahead of the modest decline from mid-December into mid-January. The buy (to open) put/call volume ratio is low from a multi-year perspective, but is also rolling over from a multi-week high, suggesting that if the ratio returns to early-December levels, this group could be behind a breakout.

“ After the SPX troughed at its Election Day close around 5,780 on Jan. 13, it surged nearly 6% to this past Thursday’s all-time closing high...Short interest figures as of mid-January will come out this week, but it may be the end-of-month data that gives us a better clue as to whether short covering helped support a rally since mid-January.”

-Monday Morning Outlook, January 27, 2025

The chart that fascinates me the most and reflects a portion of the excerpt from Bloomberg above, is the potential for a period of sustained short covering. Short interest data as of the end of January was released early last week, and there was a 3% decrease in short interest from mid-January through the end of January.

This answered my question from late-January as to whether short covering may have driven stocks sharply higher from the lows in mid-January that were at the Election Day 2024 close.

The biggest risk to bears, even with the SPX at chart resistance, is a short-covering breakout, with short interest on SPX component stocks now rolling over from multi-year highs.

Todd Salamone is Schaeffer's Senior V.P. of Research

Continue Reading: