The brokerage firm raised its price target on the FAANG stock to $450

The shares of Netflix, Inc. (NASDAQ:NFLX) are trading higher today, thanks to a bullish brokerage note. The FAANG stock was last seen up 1.3% at $413.35 -- on track for its third straight win -- and options traders are targeting even more upside by week's end.

Earlier, Barclays boosted its price target on the stock to $450 from $370 -- hardly the highest NFLX price target on Wall Street, but still sitting in uncharted territory for the shares. The brokerage firm suggested Netflix is still inexpensive relative to other streaming names like Spotify (SPOT), and said the shares are "likely to trade on the overall view toward owning tech" -- but warned "it is unlikely to be immune to sector volatility."

Additionally, Imperial Capital raised its 2019 revenue forecast for Netflix, citing optimism over international subscriber growth. The brokerage firm also believes NFLX's July 16 earnings report will showing the company added 6.11 million new subscribers in the second quarter.

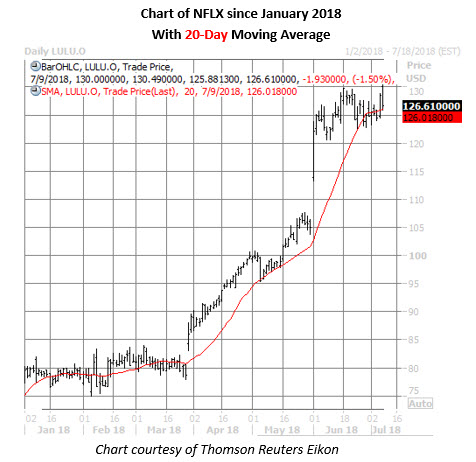

Looking at the charts, Netflix stock has been flying higher over the last 12 months, up more than 175%. In 2018 alone, the shares have more than doubled, making it the best FAANG stock so far this year. After hitting a record high of $423.21 on June 21, the security pulled back to its 20-day moving average -- and a sharp bounce from here has NFLX closing in on this milestone once more.

In the options pits, volume is slightly accelerated today, with around 95,000 calls and 70,000 puts on the tape. The weekly 7/13 series is hot, accounting for each of the equity's 10 most active options. The 415- and 420-strike calls have seen the heaviest activity, and it looks like new positions are being purchased here.

If this is the case, it just echoes the broader trend toward call buying seen among NFLX options traders. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 20-day call/put volume ratio sits at a top-heavy 1.42.

Regardless, the FAANG stock has consistently rewarded premium buyers over the past year, per its elevated Schaeffer's Volatility Scorecard (SVS) reading of 85 (out of a possible 100). In other words, NFLX has tended to make outsized moves, relative to what the options market has priced in.