The electric car company reported a 146.4% revenue increase

The shares of Nio Inc (NYSE: NIO) are down 2.3% at $45.51 at last check, despite the Tesla (TSLA) competitor announcing better-than-expected third-quarter losses, as well as a 146.4% increase in revenue from a year prior, which also beat analysts' estimates. The electric car name attributed the strong results to deliveries hitting record numbers in the last quarter. As a result, the security earned a price-target hike from J.P. Morgan Securities to $50 from $46.

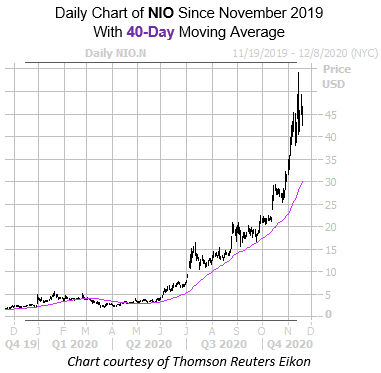

On the charts, Nio stock has been cooling off from a Nov. 13 all-time-high of $54.20. Prior to this pullback, the security had been hitting records on a monthly basis since June, with support from the ascending 40-day moving average. Year-over-year, NIO sports a jaw-dropping 2,408.7% lead.

A shift in analyst sentiment could push NIO even higher. Coming into today, five of the seven analysts in coverage called the stock a tepid "hold," while two carried a "strong buy" rating. Plus, the 12-month consensus target price of $24.27 is a whopping 47.3% discount to current levels. This leaves plenty of room for additional upgrades and/or price-target hikes moving forward.

What's more, the equity's Schaeffer's Volatility Scorecard (SVS) ranks high at 89 out of 100, meaning NIO has tended to exceed these expectations during the past year -- a boon for options buyers.