The security suffered a price-target cut from Canaccord to $9 from $10

The shares of BlackBerry Ltd (NYSE:BB) are down 9.6% at $8.45 this afternoon, after the tech concern reported fourth-quarter profits that matched Wall Street's estimates, but missed revenue expectations. The disappointing results came even as sales of its QNX car software showed improvement. In turn, Canaccord Genuity upgraded the security to "hold" from "sell," but slashed its price objective to $9 from $10. Scotiabank jumped on the bearish bandwagon as well, handing out out a price-target cut to $7.50 from $8.50.

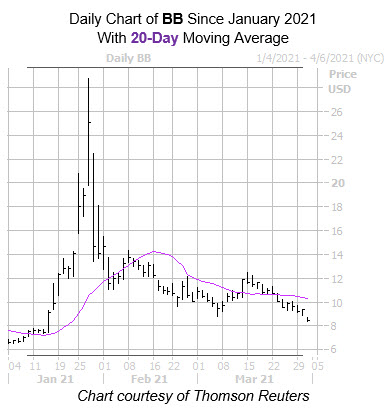

Digging deeper, the equity has struggled since a Reddit-fueled trading mania helped it to a Jan. 27, nine-year high of $28.77. Shares tumbled shortly afterwards, though, and are now roughly one-third of what they were at their peak. Plus, the security has fallen below the once-supportive 20-day moving average, even if it still sports a 106.2% year-over-year lead.

Analysts were pessimistic towards BlackBerry stock coming into today, with three of the six in coverage calling it a "hold," while the remaining three say "strong sell." Plus, the 12-month consensus target price of $7.63 is a 10.4% discount to BB's current levels.

Meanwhile, shorts have been piling on BB. Short interest is up 16.4% over the last two reporting periods, and the 37.66 million shares sold short make up 6.8 % of the stock's available float.

That pessimism is echoed in the options pits, where puts are all the rage. This is per Blackberry stock's 10-day put/call volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which sits in the 80th percentile of its annual range. In simpler terms, puts have been picked up at a faster-than-usual clip.

Lastly, now looks like a good time to weigh in on BB's next move with options. The security's Schaeffer's Volatility Index (SVI) of 119% stands in the 17th percentile of the past 12 months, indicating the equity sports affordably priced premiums at the moment.