The analyst warned of margin pressure in upcoming quarters

Skechers USA Inc (NYSE:SKX) is down 7.8% to trade at $26.35, one of the worst stocks on the New York Stock Exchange today (NYSE), after Susquehanna trimmed its price target to $25 from $26. The analyst in coverage cut their fiscal year earnings estimates for the company in 2018 and 2019, citing margin pressure from lower sales in Asian and Latin America markets.

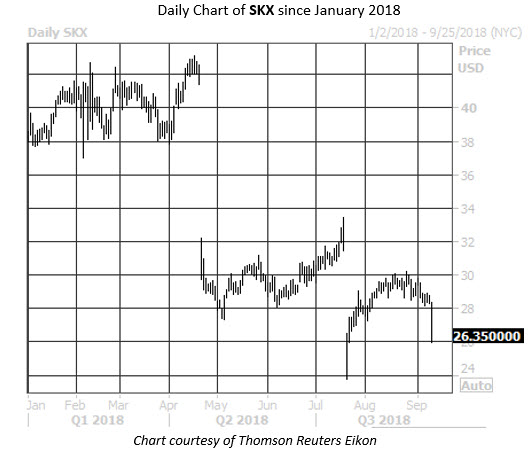

Skechers stock is on track for its worst day since an earnings-induced bear gap on July 20. Since then, the shares have struggled to rally north of the $30 region. The sneaker retailer has now given back 30% in 2018, and is only a fractionally above its year-over-year breakeven level.

In the options pits, puts have been popular in recent weeks, despite limited absolute volume. More than 1,315 puts were bought to open on SKX during the past 10 days at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), compared to just 673 calls. The resultant 10-day put/call volume ratio ranks in the 98th percentile of its annual range, indicating not only that puts nearly doubled calls, but the high percentile rank shows the rate of put buying relative to call buying has been quicker than usual.

Shifting gears to today, the skepticism in the options pits has ramped up. Roughly 8,000 puts have been traded, six times what's typically seen at this point in the day, and volume pacing for the 97th percentile of its annual range. Most active is the September 26 put, where new positions are being opened for a volume-weighted average price (VWAP) of $0.58. As such, breakeven for the put buyers at next Friday's close is $25.42 (strike less premium paid).