The cybersecurity firm posted impressive third-quarter earnings

The shares of FireEye Inc (NASDAQ:FEYE) are up 10.8% to trade at $18.88 -- headed toward their best day since May 2017 -- after the cybersecurity company reported third-quarter adjusted earnings of 6 cents per share on $211.65 million in revenue, more than analysts were expecting. The impressive results came as FireEye shifted to a subscription-based model, and earned the stock no fewer than four price-target hikes, including one to $23 at Baird.

This optimism is being echoed in FEYE's options pits, too, where roughly 22,000 calls and 5,800 puts have changed hands -- three times what's typically seen at this point. Most active by a mile is the weekly 11/2 19-strike call, where it looks like new positions are being purchased for a volume-weighted average price of $0.32. If this is the case, breakeven for the call buyers at this Friday's close, when the options expire, is $19.32 (strike plus premium paid).

Widening the scope reveals speculative players have been loading up on long calls at a quicker-than-usual clip in recent weeks, relative to long puts. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), FEYE's 10-day call/put volume ratio of 7.45 ranks in the 72nd annual percentile.

While some of this activity is likely at the hands of traditional bulls, it's also possible short sellers are using long calls to hedge against any additional upside risk. Short interest rose 21.4% in the latest reporting period, to 26.62 million shares -- representing 14% of FEYE's available float, or five times the average daily pace of trading.

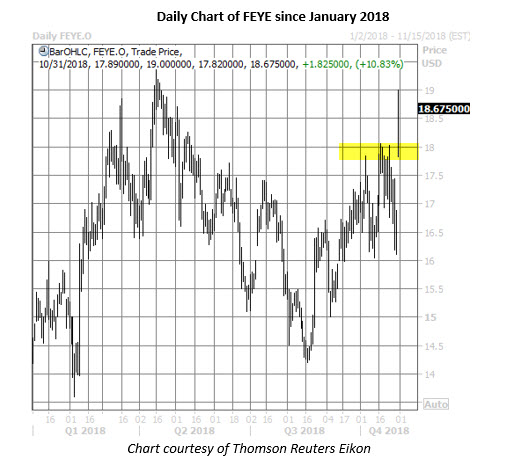

What's impressive is FireEye stock's ability to rally in the face of such intense selling pressure, speaking volumes to its underlying strength. While the broader stock market is staring at its biggest monthly loss in years, FEYE shares are set to end October with a 9.8% gain -- bringing their monthly win streak to four. The equity has now broken out above former congestion near $18, and is within striking distance of its April 16 two-year high of $19.36.