The stock is ripe for a round of upgrades, too

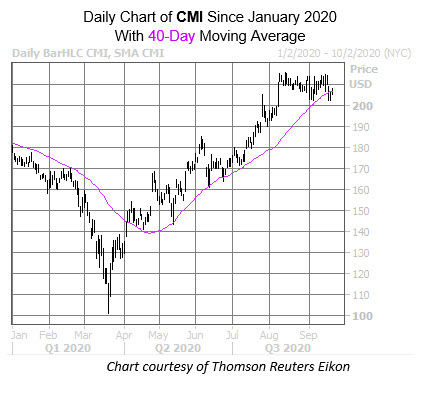

Auto parts manufacturer Cummins Inc. (NYSE:CMI) has flagged out for the past month since its mid-August all-time highs. More recently, the shares have formed a bullish engulfing candle, with support emerging at their 40-day moving average.

There’s plenty of room for upgrades, considering 13 of 17 dole out tepid “hold” ratings. And in the options pits, puts reign supreme, according to the security's Schaeffer's put/call open interest ratio (SOIR) of 2.32, which ranks higher than all but 8% of readings from the past year. An unwinding of pessimism in the options pits could act as a tailwind going forward.

The good news for options traders is that the stock’s Schaeffer’s Volatility Index (SVI) of 31% sits higher than just 15% of all other annual readings, meaning options traders are pricing in relatively low volatility expectations at the moment. Plus, CMI’s combination of cheap options and record highs has been a bullish indicator in the past. Our recommended call option has a leverage ratio of 5.9 and will double in a 16.8% decline in the underlying equity.

Subscribers to Schaeffer's Weekend Trader options recommendation service received this CMI commentary on Sunday night, along with a detailed options trade recommendation -- including complete entry and exit parameters. Learn more about why Weekend Trader is one of our most popular options trading services.