Investors are buying the dip on PACW

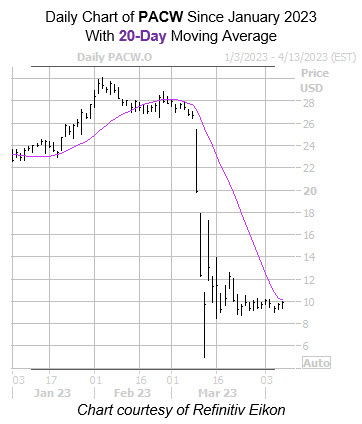

PacWest Bancorp (NASDAQ:PACW) stock is up 1.8% at $9.88 this afternoon, but carries a 74.4% year-to-date deficit. The $8 region has provided a floor for the shares after a series of bear gaps pressured them to a March 13, record low of $5. Meanwhile, the 20-day moving level has kept a lid on PACW since February, and is stifling today's gains as well.

Options traders seemingly view the bank stock's troubles as an opportunity to buy the dip. The equity showed up on Schaeffer's Senior Quantitative Analyst Rocky White's list of S&P 400 Mid Cap Index (IDX) stocks that attracted the highest weekly options volume over the last 10 days. PACW drew 188,399 calls and 89,950 puts, with the weekly 3/31 9.50-strike call standing out as the most popular contract.

Short sellers are still piling on, however. Short interest added a whopping 176.2% in the most recent reporting period, and the 11.44 million shares sold short now make up 9.8% of the stock's available float.