Options traders are targeting CVX after its upbeat preliminary results

Chevron Corp (NYSE:CVX) stock is at the top of the Dow today, up 2.6% at $162.86 -- earlier as high as $164.03. The company posted upbeat preliminary second-quarter results, ahead of the oil giant's scheduled earnings report, due out before the open Friday, July 28. Plus, Chevron announced that it is no longer mandatory for CEO Michael Wirth to retire at 65, and that Eimear Bonner (the current CTO) will replace Pierre Breber as CFO next year.

Chevron stock has a mixed post-earnings history over the last two years -- finishing higher after four of the last eight next-day sessions. The options pits are pricing in a 3.1% move after earnings, which is just above the 3% swing the stock has averaged over this time.

Today, CVX has already seen 2.8 times its average daily options volume in the options pits. So far, 61,000 calls and 32,000 puts have been exchanged. The weekly 7/28 165-srike and 165.50-strike calls are the most popular, with new positions being opened at both.

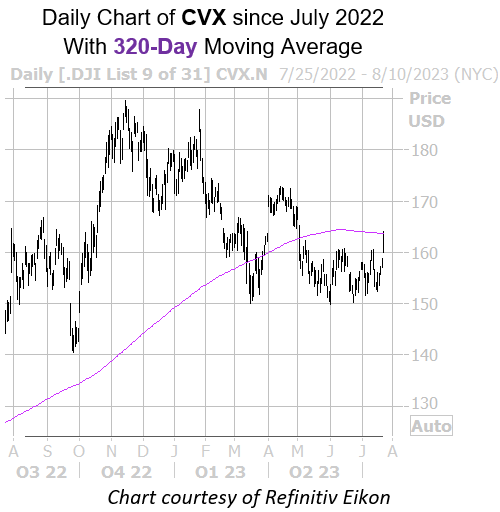

Today's pop has CVX jumping above pressure at the $160 level, though its 320-day moving average is keeping gains in check. Year-to-date, the equity is down 9.3%.